What Are GLP-1 Weight Loss Injections?

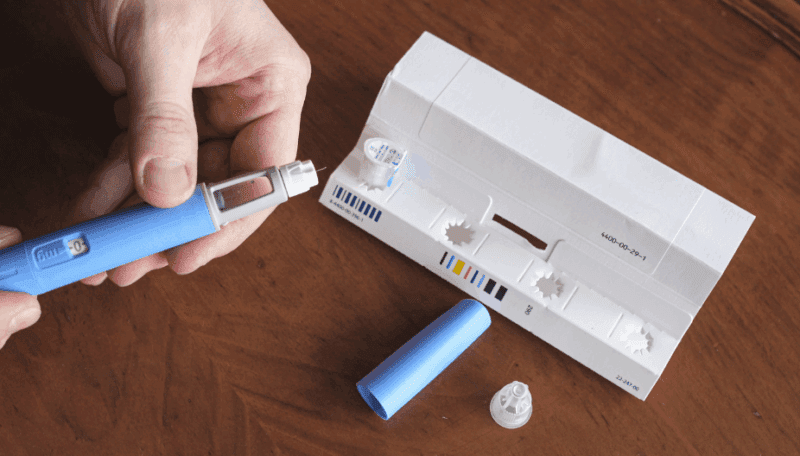

As global obesity rates soar, weight-loss injections such as Ozempic, Mounjaro, Wegovy, Cagrisema, and Rybelsus are on the rise. These medications belong to a class of drugs known as GLP-1 agonists; they help people lose weight by decreasing food intake and sending satiety signals to the brain, thus reducing appetite and cravings. [1]. The injections gained popularity in 2022 as celebrities and influencers shared their weight-loss journeys [2]. The past year has witnessed the significant growth of Ozempic, with over 340,000 patients between March 2024 and February 2025 in the UK alone [2]. The Ozempic wave signals no signs of plateau, as the global market is expected to be worth ten billion (USD) by 2035 [3].

Whilst Ozempic and alternatives are beneficial for weight management, the side effects have had an impact on outside economies. This blog will explore how Ozempic is set to disrupt the life sciences sector.

The Rise of GLP-1 in the UK

Thinness will always be the ideal body standard, but as more individuals shrink themselves, there is greater pressure to meet these expectations [4]. Originally, weight-loss drugs were used to treat medical conditions and were exclusive to celebrities with connections, however, they have hit the mainstream market, with 1.6 million UK cases expected in the next 12 years [5]. “Ozempic influencers” have expanded the discussion, normalising GLP-1 medications as a tool for fat loss [6]. Influencers are taking to social media to sell the drugs, offering discount codes and advice to their followers, who appear to be soaking it up [6].

Challenges of GLP-1

Patients have reported symptoms of Ozempic that extend beyond weight loss. “Ozempic face”, “Ozempic mouth”, and “Ozempic feet” are just some of the terms circulating online [7]. The extreme weight loss is thought to leave patients with sagging, loose skin as they experience a rapid decline in fat and muscle mass [8]. The skin’s texture is also affected, with skin looking aged, feeling rubbery and lacking elasticity [9].

Emerging evidence, however, suggests these effects are not solely attributable to weight loss. GLP-1 receptor agonists (GLP-1RA) also act directly on adipose-derived stem cells (ADSCs) and fibroblasts. This receptor activity reduces protective cytokine production, increases oxidative stress, limits glucose uptake and ATP generation, and drives apoptosis. In parallel, reduced estrogen signalling from dermal adipose tissue decreases fibroblast stimulation, impairing collagen synthesis. GLP-1RA have also been shown to influence skin ageing through interactions with advanced glycation end products (AGEs) and their receptors (RAGE).[10]

In addition, recent commentary in The Lancet highlights that when weight loss is medically induced, including via GLP-1RA therapies, up to 25-39% of the weight lost over about 9-18 months (36-72 weeks) can come from fat-free mass (including skeletal muscle) rather than fat alone. This has important implications: muscle loss can exacerbate skin sagging, reduce metabolic health, and compromise strength and recovery, especially when protein intake is low. [11]

Taken together, these mechanisms indicate that the skin changes seen in patients may arise from both the structural consequences of fat and muscle loss and the direct cellular effects of GLP-1RA on skin biology.

Beyond dermatological concerns, patients also report oral side effects. “Ozempic tongue” is used to describe dysgeusia, a disorder that changes the flavour of food, leaving metallic, sour, bitter and sweet tastes in the mouth [12]. Xerostomia (dry mouth) is a byproduct of Ozempic as saliva production stalls [12]. This can cause tooth decay, gum disease, bad breath, tooth loss and overall bad oral hygiene [12].

Product Development & Opportunities for Health & Beauty

This innovation in weight loss calls for development; brands are beginning to see the potential for products aimed at Ozempic users.

Health & Nutrition companies are capitalising on the growing market created by GLP-1 usage and its nutritional side effects, particularly protein deficiency and loss of lean mass. Danone has taken over Kate Farms and launched a high-protein, plant-based nutrition shake formulated to address nutritional gaps in the Ozempic diet, particularly protein deficiency [13]. They worked directly with patients to develop flavours suited to new taste palates [13]. Nestlé is also chasing the Ozempic consumer with a new line of frozen meals called Vital Pursuit [14]. They claim to be rich in protein, vitamin A, potassium and calcium and offer gluten-free alternatives [14].

These changing tastes present an opportunity for natural flavours and vanilla extracts. If new tastes are being sought, due to changing palettes, then sophisticated flavours within the scope of traditional vanilla extract are available. Single-origin vanilla extracts from Tahitian, Ugandan, Indonesian and Mexican each give a subtly different flavour profile to the more traditional Madagascar Bourbon, which is rich, sweet and creamy. For example, the Mexican Pure Vanilla extract from Nielsen-Massey gives a sweet and woody note, similar to clove or nutmeg and works well with chocolate.

Food nutrition brands could also consider the protein deficiency and loss of lean mass mentioned above by adding creatine as a supplementary nutrient and combining an education piece, targeted towards GLP-1 users, on protecting and building muscle mass and the function of creatine. Creapure® from Alzchem group claims it can help to stop loss of muscle mass and improve mental clarity.

Meanwhile, Kourtney Kardashian’s brand Lemme has launched a supplement gummy containing natural ingredients, marketed as a non-injection substitution for customers interested in similar wellness benefits [15].

Ozempic has reshaped the beauty economy [16]. The industry has profited from fears of “Ozempic face” [17]. Skincare is being used to reverse wrinkly, sagging skin; SkinCeuticals has released a serum specifically targeting this demographic [18]. Natural active ingredient supplier SILAB has a number of advanced skincare solutions, two of which are VOLUNAGE® and ETERNALINE®, these science-backed actives can help to restore facial fullness and firmness, to support a rejuvenated appearance. In terms of treatment, the aesthetics market has boomed, with patients opting for easy filler and Botox fixes [15]. Skims has even launched a face sculpting mask that claims to lift and tighten the face [19].

There also appears to be an emerging market for the oral care sector. American grocery stores have noticed a rise in gum and mint sales, perhaps a result of “Ozempic mouth” [20]. This creates an opportunity for oral care companies to invest in marketing towards Ozempic patients. Functional cosmetic ingredients available in the market can provide hydration, reduce inflammation and help repair damaged gum tissue. Biomoist from Bloomage Biotechnology is available through Cornelius and can be used in various oral care products, such as toothpaste and mouthwash.

Regulation and Formulation Considerations

The food, beverage and cosmetics industries call for regulatory and formulation considerations. Food products aimed at Ozempic users must be classified as supplements and comply with UK regulations. Despite containing key nutrients, they are not to be mistaken as substitute meals for a balanced diet. In the cosmetics sector, this includes skin and oral care; products must adhere to laws prohibiting misleading claims; therefore, brands cannot claim directly that their products treat Ozempic side effects. To avoid legal disputes, brands use terms relating to loose, sagging, wrinkly and aged skin. Formulations for food must address dysgeusia, oral care must cater to dry mouth symptoms, and skincare must improve elasticity and fullness.

Long-term Impact on the Life Sciences Sector

GLP-1 Injections as part of the future wellness?

Having witnessed Ozempic’s influence on the life sciences sector, it is reasonable to assume the market will continue to expand. The increase in GLP-1-compliant foods signals a change where medical nutrition and mainstream food overlap. We can expect to see more nutritionally functional products stocked in supermarkets, not just pharmacies.

Retailers may even dedicate specific in-store sections to GLP-1 users, offering products tailored to reduced appetite and new nutritional demands. As the consumption of highly processed foods declines, the demand for food that prioritises nutrient density over indulgence is likely to increase. This reflects the growing rise of the “food as medicine” concept: as patients eat less, the food they do consume will need to be more carefully considered, delivering the right balance of protein, vitamins, minerals, and functional ingredients to support long-term health and wellbeing.

The healthcare implications are equally significant. Obesity is already linked to over 4 million deaths globally each year through related complications such as cardiovascular disease, diabetes, and cancer. If GLP-1 therapies contribute to lowering obesity rates, the long-term effect could be transformative: more people living longer, healthier lives. Morgan Stanley notes that this will reshape demands on healthcare, pharmaceuticals, and elder-care services, with the life sciences sector benefiting from increased longevity and a growing older population [21]

At the same time, food and consumer goods companies will need to adapt to this shifting landscape. As highlighted by PwC, businesses across the value chain, from retailers and manufacturers to restaurants and catering services, will be challenged to offer lower-calorie, nutrient-rich choices and to provide new forms of support such as nutrition planning tools, clearer labelling, and health certifications. Reformulation will also be essential, as GLP-1 users move away from traditional flavour preferences and seek products aligned with their changing appetites [22]. Companies that can innovate quickly, maintain competitive pricing, and clearly communicate nutritional benefits will be best positioned to capture this emerging market.

Opportunities for Personal Care Industries

Beyond food and nutrition, these trends are also reshaping personal care, aesthetics, and wellness. According to McKinsey, one of the main concerns for many GLP-1 users is skin laxity, especially around the face and neck, as fat and volume loss become more evident. Many are also seeking treatments to improve skin texture and facial fullness after rapid weight loss. [23] The loss of subcutaneous facial fat pads not only alters appearance but places new demands on aesthetic care: skincare, dermal fillers, tightening devices and collagen-boosting actives. [24]

Aesthetic clinics are reporting a surge in demand for procedures such as facial volumisation, radiofrequency skin tightening, non-surgical contouring, and dermal filler treatments to address sagging and crepey skin resulting from rapid weight loss with GLP-1 medications. [23] Moreover, skin conditions like inflammation, texture changes, delayed wound healing, and increased perception of ageing appear more frequently among GLP-1 users. [25]

Beauty standards are likely to evolve in response. As thinness becomes more achievable, ideal may shift toward a tone, resilience, youthful skin, and overall vitality, traits harder to achieve purely through appetite suppression. The rise in demand for appearance-preserving solutions suggests personal care, wellness, and medical aesthetics industries are entering a new phase: one in which function (skin health, tissue integrity, recovery) matters as much as form (shape, slimness).

References

[1] Fiorella Valdesolo. (2023, February 10). What You Need to Know About Ozempic: The Diabetes Drug Fuelling Hollywood’s Harmful Weight-Loss Obsession. British Vogue.

[2] TrimRX | The Rise of Ozempic: When Did It Become Popular for Weight Loss? (2025). Trimrx.com.

[3] Tyagi, I. V., & Anand, S. (2025, January 31). Ozempic Market Size, Trends, Demands, Growth Report 2035 | MRFR. Marketresearchfuture.com; Market Research Future.

[4] Pantony, A. (2024, September 13). Lottie Moss Has Overdosed On Ozempic. What Happened To Body Positivity? Glamour UK.

[5] Reid, R. (2024, December 19). Is Ozempic Fuelling The Rise Of “Labia Puffing” Procedures? Glamour UK

[6] Meyerowitz, A. (2025, January 26). The Rise of the Ozempic Influencers. Glamour UK.

[7] ] Mills, D. (2025, April 29). Ozempic May Cause Cosmetic Side Effects Like Sagging Skin, Wrinkly Feet. Healthline; Healthline Media.

[8] Mills, D. (2025, April 29). Ozempic May Cause Cosmetic Side Effects Like Sagging Skin, Wrinkly Feet. Healthline; Healthline Media.

[9] Nesvig, K. (2024, August 13). Ozempic Is Changing People’s Skin, Say Plastic Surgeons. Glamour UK.

[10] Paschou, I.A., Sali, E., Paschou, S.A. et al. GLP-1RA and the possible skin aging. Endocrine 89, 680–685 (2025).

[11] Muscle matters: the effects of medically induced weight loss on skeletal muscle

[12] Lee, B. Y. (2025, May 24). “Ozempic Teeth,” “Tongue,” “Breath” As Possible GLP-1 Med Oral Effects. Forbes

[13] Anay Mridul. (2025b, July 8). Now Owned by Danone, Kate Farms Targets Ozempic with High-Protein Plant-Based Nutrition Shakes. Green Queen.

[14] Gleeson, C. (2024, May 21). Nestlé Launching A Frozen Food Brand Aimed At Ozempic and Wegovy Users. Forbes.

[15] Doolan, K. (2025). Beauty innovation for “Ozempic Face.”

[16] How Ozempic will change the skin care industry in 2025. (2024). Cosmeticsbusiness.com.

[17] Kallor, A. (2025, July 10). “Ozempic Face” Is Real. But There’s Skincare for That. Harper’s BAZAAR.

[18] Bermingham, L. (2025, August 12). This new serum for sagging skin was tested on Ozempic users. EVOKE.

[19] Matos, P. (2025, January 16). Weight Loss Supplements That Complement Ozempic. Vidafuel

[20] Anay Mridul. (2025a, January 17). New GLP-1 Study Says Grocery Spending Goes Back To Normal After 1 Year of Use. Green Queen.

Prado, Carla M et al. The Lancet Diabetes & Endocrinology, Volume 12, Issue 11, 785 – 787

[21] Morgan Stanley. (2024, April 14) Obesity Medication: Ripple Effects

[22] ECHEMI. (2025, January 7) GLP-1 Weight Loss Drugs Will Disrupt the Market, $133 Billion Change

[23] McKinsey & Company. (2025, May 15). GLP-1s are boosting demand for medical aesthetics. McKinsey.

[24] Haykal D, Hersant B, Cartier H, Meningaud JP. (2025, Feburary 24). The Role of GLP-1 Agonists in Esthetic Medicine: Exploring the Impact of Semaglutide on Body Contouring and Skin Health. J Cosmet Dermatol.

[25] Persson, C., Eaton, A., & Mayrovitz, H. N. (2025). A Closer Look at the Dermatological Profile of GLP-1 Agonists. Diseases, 13(5), 127.